Growth

Money Required to Start a PG in 2026

Written by

Anil Kandpal

Read Time

3 min read

Posted on

January 16, 2026

Overview

Overview

If you ask 10 people how much it costs to start a PG business, you’ll get answers ranging from ₹3 lakhs to ₹1 crore.

Both are technically correct – and both are dangerously misleading.

In 2026, the real question is not “How much money do I need?” The real question is:

“How much money do I need so that my PG does not collapse in the first 12 months?”

This article breaks that down from a business survival lens, not a YouTube-reel lens.

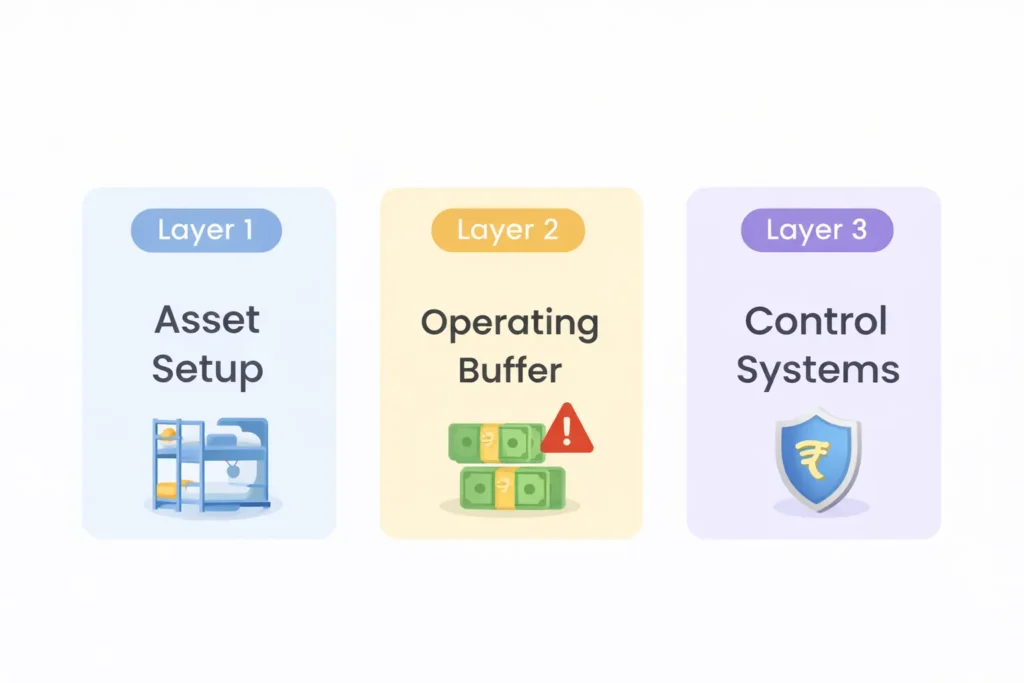

The 3 Layers of PG Investment (Most Blogs Miss This)

Most cost guides only talk about setup cost. In reality, PG investment has three distinct layers:

Layer 1: Asset Setup (Visible Cost)

Beds, cupboards, painting, deposit – what everyone talks about.

Layer 2: Operating Buffer (Ignored Cost ❌)

Cash needed to survive:

- Vacancies

- Late rent

- Repairs

- Staff inefficiency

Layer 3: Control Systems (Silent Profit Maker)

How you prevent leakage, not just earn rent.

👉 Most PGs fail at Layer 2 and Layer 3, not Layer 1.

Let’s go layer by layer.

Layer 1: Setup Cost (Reality Check for 2026)

A. Property Economics (Rented vs Owned)

Rented PG (Most First-Time Owners)

| Item | Typical Range |

| Monthly rent | ₹1.5L – ₹2.5L |

| Security deposit | ₹1.5L – ₹6L |

| Lock-in period | 2-5 years |

Hidden insight: Owners fixate on low rent, but ignore vacancy velocity. A slightly costlier location near colleges / IT hubs often fills 2–3x faster, saving months of losses.

B. Renovation: Where Capital Gets Burnt

2026 truth: Tenants don’t pay more for marble floors. They pay for experience.

| Expense Head | Smart Spend |

| Paint & repairs | ₹1–2L |

| Electrical & plumbing | ₹80k–₹1.5L |

| Bathrooms | ₹1–3L |

| Safety (CCTV, locks) | ₹40k–₹1L |

Owner mistake: Overspending on interiors → underfunding operations.

C. Furniture: Think “Per Bed ROI”

Average per-bed cost in 2026:

| Item | Cost |

| Bed + mattress | ₹5k–₹10k |

| Cupboard | ₹6k–₹9k |

| Table/chair | ₹2k–₹5k |

| Fan & lighting | ₹2k–₹3k |

➡️ ₹15k–₹32k per bed

Insight: Every ₹5,000 extra per bed needs ₹300–₹400 extra monthly rent just to break even.

Layer 2: Operating Buffer (Where PGs Actually Die)

This is the most under-calculated cost.

You MUST Assume These Will Happen:

- 15–25% beds vacant initially

- 10–20% tenants delay rent

- Staff forgets / hides collections

- Electricity, water, food overshoots estimates

Minimum Operating Buffer (Rule of Thumb)

| PG Size | Required Buffer |

| 10–15 beds | ₹1.5–2L |

| 20–30 beds | ₹3–5L |

| 50+ beds | ₹8–12L |

❌ Owners who invest every rupee into setup usually panic within 90 days.

Layer 3: Control Systems (This Decides Profit vs Stress)

Here’s a brutal truth:

A PG without systems is not a business – it’s a gambling table.

Where Money Leaks in PGs

- Cash collected but not recorded

- Partial payments forgotten

- Electricity & food dues unrecovered

- No clarity on monthly profit

- Owner realizes losses after 6 months

This is exactly why modern PG owners use RentOk.

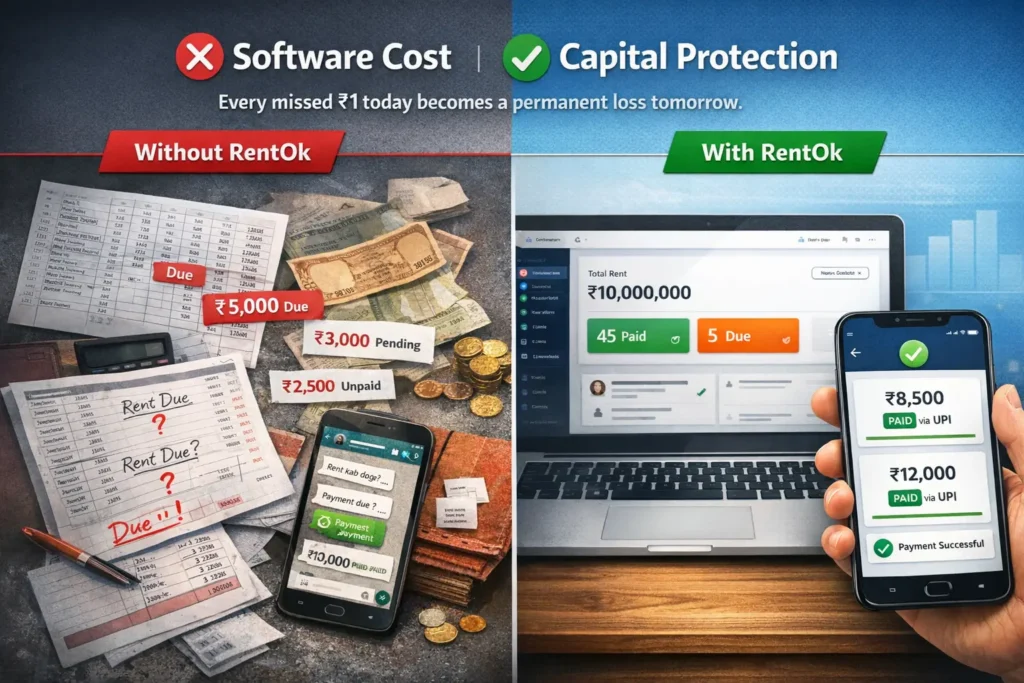

Why RentOk Is Not “Software Cost” – It’s Capital Protection

When you invest ₹20–50 lakhs into a PG, managing it on Excel + WhatsApp is like running a factory without accounting.

What RentOk Controls (Practically)

- Automated rent & dues tracking (no memory dependence)

- UPI-based collections (less cash leakage)

- Tenant-level ledger (no disputes)

- Expense vs collection dashboard (real profit visibility)

- Defaulter & overdue alerts (faster action)

📉 Even 5% monthly leakage on a ₹5L rent roll = ₹25,000/month lost.

📈 RentOk typically saves ₹20k–₹50k/month for mid-sized PGs.

That’s not convenience. That’s ROI.

Realistic Investment Summary (2026)

Example: 25-Bed PG in Tier-1 / Tier-2 City

| Category | Amount |

| Deposit + rent advance | ₹4–5L |

| Renovation | ₹2–5L |

| Furniture & appliances | ₹4–5L |

| Legal & setup | ₹20k–₹1L |

| Operating buffer | ₹4–5L |

| Total | ₹12–27L |

➡️ Break-even: 14–20 months (well-managed)

➡️ Without systems: unpredictable

Final Insight: PG Is No Longer a “Side Business” in 2026

The PG business has matured.

Tenants expect:

- Digital payments

- Clear dues

- Transparency

Owners need:

- Predictable cash flow

- Zero leakage

- One dashboard view

RentOk is built exactly for this new reality.

If you’re committing serious money, you need serious control.

About the Author

Anil Kandpal

Anil Kandpal is the Head of Marketing at RentOk and a seasoned property rental industry expert with over 8 years of hands-on experience in the PG, hostel, and co-living sectors. Since 2017, Anil Kandpal has built deep expertise across every facet of the property rental ecosystem. He founded Capho, a PG and hostel aggregator platform that connected renters with quality accommodation options across India. Following this, he spent two years as an operator, managing his own co-living and PG business, giving him invaluable first-hand insights into the challenges faced by property owners and managers. Currently, Anil Kandpal leads growth and marketing strategies at RentOk, a B2B SaaS property management platform, where he helps PG owners, hostel operators, and property managers streamline their operations and scale their businesses. His unique perspective combines entrepreneurial experience, operational expertise, and data-driven marketing strategies, making him a trusted voice on topics including PG management, rental property operations, tenant acquisition, and PropTech solutions.

...read moreAnil Kandpal is the Head of Marketing at RentOk and a seasoned property rental industry expert with over 8 years of hands-on experience in the PG, hostel, and co-living sectors. Since 2017, Anil Kandpal has built deep expertise across every facet of the property rental ecosystem. He founded Capho, a PG and hostel aggregator platform that connected renters with quality accommodation options across India. Following this, he spent two years as an operator, managing his own co-living and PG business, giving him invaluable first-hand insights into the challenges faced by property owners and managers. Currently, Anil Kandpal leads growth and marketing strategies at RentOk, a B2B SaaS property management platform, where he helps PG owners, hostel operators, and property managers streamline their operations and scale their businesses. His unique perspective combines entrepreneurial experience, operational expertise, and data-driven marketing strategies, making him a trusted voice on topics including PG management, rental property operations, tenant acquisition, and PropTech solutions.