Legal

Can HRA be Claimed Without a Rent Agreement?

Written by

Shivanshi Dheer

Read Time

3 min read

Posted on

July 5, 2025

Overview

For many salaried individuals in India, House Rent Allowance (HRA) is an important component of their salary structure. But what happens if you don’t have a formal rent agreement with your landlord? Can you still claim HRA? In this guide, we’ll explore:

- What is HRA, and who is eligible?

- Documents required for the claim?

- Can you claim HRA without a rent agreement?

- Alternatives and best practices

- Tips to avoid trouble with claims

Understanding HRA and Eligibility

House Rent Allowance (HRA) is the portion of your salary provided by your employer to meet rental expenses. It’s partially exempt from tax under Section 10(13A) of the Income Tax Act.

Who is eligible?

- Salaried individuals living in rented accommodation.

- Cannot claim HRA if you live in your own house.

- Must be paying rent and living away from your place of posting or in a different city.

Documents Required for HRA Claim

To claim HRA tax exemption, employers typically require:

- Rent Agreement (Rental Deed): Proof of rental contract between tenant and landlord.

- Rent Receipts: Monthly receipts bearing the landlord’s signature.

- Landlord’s PAN Card: Mandatory if annual rent paid exceeds ₹1 lakh.

- Employee Declaration: Self-declaration of rent paid and address.

Can You Claim HRA Without a Rent Agreement?

Scenario 1: Missing Formal Rent Agreement

Partial Claim Possible: Some employers may accept alternative proofs (e.g., rent receipts, landlord’s affidavit).

Tax Department Scrutiny: Without a registered rent agreement, claims can be challenged during income tax assessment.

Risk of Penalty: If examined, lacking a proper rent agreement may lead to disallowance of HRA benefits and demand for unpaid tax along with interest.

Scenario 2: Informal or Verbal Agreement

- Employer’s Discretion: Few employers might process HRA based on rent receipts only, but this is not foolproof.

- Proof of Payment: Bank transfers to the landlord’s account can help substantiate rent paid.

Key Takeaway: While some employers may allow claims with minimal documentation, for tax exemption comfort and legal safety, a registered rent agreement is highly recommended.

👉Dont forget to check out the checklist before making your rent agreement.

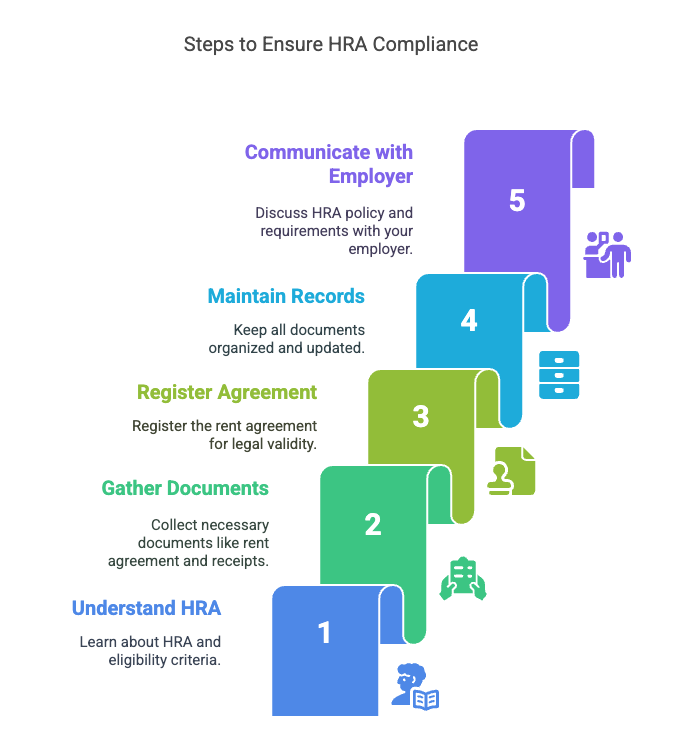

Alternatives and Best Practices

- Get a Registered Rent Agreement: Register the agreement at the local sub-registrar to make it legally valid.

- Collect Rent Receipts Diligently: Ensure each receipt has a date, amount, landlord’s signature, and address.

- Use Online Rent Platforms: Platforms like RentOk, NOC Rent, and NoBroker can help generate valid rent agreements and receipts.

- PAN Compliance: Ensure landlord shares PAN if rent > ₹1 lakh/year.

Tips to Avoid HRA Claim Trouble

- Maintain Consistency: The rent agreement date, name, and rent amount should match all documents.

- Update Agreement: Renew and register the agreement if your tenancy period extends beyond the original term.

- Keep Record: Store scanned copies of rent receipts, bank statements, and agreements in one folder.

- Communicate with Employer: Understand your company’s HRA policy and documentation requirements.

Conclusion: While a rent agreement is the gold standard proof for claiming HRA, you can sometimes claim without it, but it is subject to your employer’s discretion and risk of inspection. For peace of mind and maximum exemption, always maintain a proper, registered rent agreement along with consistent supporting documents.

Need Help? RentOk can assist you with generating valid rent agreements, automated rent receipts, and PAN-compliant landlord documentation.

About the Author

Shivanshi Dheer

Shivanshi Dheer sharing actionable strategies and information on PG/hostel management to help simplify renting and scale with RentOk.