Market Trends

Top Cities with Highest Rental Yield in India in 2025

Written by

Shivanshi Dheer

Read Time

18 min read

Posted on

August 7, 2025

Overview

Overview

Top Cities with Highest Rental Yield in India in 2025

Buying property in India can help you earn good money, especially if you rent it out. To know how much you can earn from rent, you need to understand something called “rental yield.” It tells you how much rent you get compared to the price of the property. In 2025, some cities will give better rental income because of more jobs, growing cities, and strong economies.

In this blog, we will explain what rental yield means, how to calculate it, and which cities in India are giving the best rental income in 2025. We will also look at what things affect rental yield and how to choose the best place to invest. Knowing this will help you make better choices and earn more from your property.

What is Rental Yield?

Rental Yield means how much money you earn from renting your property in one year, compared to the price of the property. It helps people decide if a property is a good investment or not. If a house is expensive but gives very little rent, the rental yield is low. But if a house is affordable and gives good rent, the rental yield is high.

How to Calculate Rental Yield?

Calculating rental yield is simple, but there are two types you should know: Gross Rental Yield and Net Rental Yield. Both tell us how much money you can earn from your property, but net rental yield gives a clearer picture because it includes all costs.

Gross Rental Yield Formula

This is the basic way to calculate rental income. It only looks at how much rent you earn in a year and the price of the property. It does not include any expenses like repairs or taxes.

Example:

If you earn ₹3,60,000 per year in rent and the property costs ₹1 crore (₹1,00,00,000), then:

Gross Rental Yield = (₹3,60,000 / ₹1,00,00,000) × 100 = 3.6%

This means you’re earning 3.6% of the property’s value every year from rent.

But remember this doesn’t include costs like maintenance, tax, or vacancy. So it’s just a starting point.

Net Rental Yield Formula

Net rental yield is more accurate because it subtracts all the costs you pay every year to manage the property.

Formula:

Net Rental Yield = ((Annual Rent − Annual Expenses) / Property Price) × 100

Expenses can include:

- Property taxes

- Repairs and maintenance

- Insurance

- Property manager fees

- Time when the house is empty (no rent)

- Society or building fees (HOA fees)

Example:

Using the same numbers:

- Annual Rent = ₹3,60,000

- Property Price = ₹1,00,00,000

- Expenses = ₹60,000

Now: Net Rental Yield =

((₹3,60,000 − ₹60,000) / ₹1,00,00,000) × 100

= (₹3,00,000 / ₹1,00,00,000) × 100

= 3.0%

So the net rental yield is 3%, which is less than the gross yield. This shows why it’s better to look at net rental yield. It tells you how much real money you make after all the costs.

What is the average rent yield in India?

In India, rental yield for homes has usually been quite low compared to other countries. Most houses gave only 2% to 3% rental yield per year in the past.

In 2025, experts say the average gross rental yield in India will be around 5% to 5.5% for homes. This means people are now earning better rent from their properties than before.

In fact, one report showed that rental yield increased from 4.39% in early 2024 to 4.84% by mid-2025.

But remember, this is just an average for all of India. Some cities give more rental income, and some give less. Even in the same city, one area might give more rent than another.

Also, the type of property matters:

- Homes usually give 3% to 5%.

- Shops or offices (commercial properties) can give 7% to 10%.

So, when investing, it’s important to look closely at the city, area, and property type to know how much rent you can really earn.

Best Cities in India for High Rental Yield (2025)?

Some cities in India give better rent than others. This is because they have more jobs, growing populations, and better infrastructure. Let’s look at the best cities to earn rental income in 2025.

Bengaluru (Bangalore)

Bengaluru is called the Silicon Valley of India. It has many IT companies and startups, which bring lots of young workers to the city.

- Rental yield: 3.5% to 4.5% (some places 5% to 7%)

- Popular areas: Whitefield, Sarjapur Road, HSR Layout, Electronic City

- Why it’s good: Metro expansion, job demand, and steady rent growth.

Mumbai

Mumbai is the financial capital of India. Property prices are high, so rental yields are a bit low.

- Rental yield: 2% to 2.5% (some places 4% to 5%)

- Popular areas: Bandra, Powai, Thane, Navi Mumbai

- Why it’s good: Always high demand for homes due to jobs and metro projects.

Gurugram

Gurugram/Gurgaon is a tech and business hub near Delhi with many big companies and modern buildings.

- Rental yield: 2.5% to 4% (offices can go up to 8%)

- Popular areas: DLF Cyber City, Golf Course Road, New Gurugram

- Why it’s good: Good jobs, new buildings, and constant rental demand.

Noida

Noida is a planned city with good roads and metro. It is also growing fast in IT and education.

- Rental yield: 2.6% to 3.2% (some areas 4% to 6%)

- Popular areas: Sector 62, Sector 150, Noida Expressway

- Why it’s good: New airport, student population, and affordable property.

Hyderabad

Hyderabad is growing fast as an IT hub, and home prices are still affordable compared to other big cities.

- Rental yield: 4% to 5% (some areas report 5%+)

- Popular areas: HITEC City, Gachibowli, Financial District

- Why it’s good: More jobs, better roads, and steady rental income.

Pune

Pune is known for its IT companies and colleges, so many professionals and students live here.

- Rental yield: 3% to 4% (some areas 5%+)

- Popular areas: Hinjewadi, Viman Nagar, Dhanori, Koregaon Park

- Why it’s good: Young renters, metro work, and good property prices.

Chennai

Chennai has both industries and IT companies, and also has many colleges and universities.

- Rental yield: Around 3.5% to 4% (some reports say up to 6%)

- Popular areas: OMR Road, Tambaram, Porur, Ambattur

- Why it’s good: Good public transport and many renters from other states.

Ahmedabad

Ahmedabad is a fast-growing city in Gujarat with strong industries and smart city plans.

- Rental yield: Around 3.9% to 4.1%

- Popular areas: SG Highway, Bopal, Satellite

- Why it’s good: Low property cost and increasing demand.

Kolkata

Kolkata is known for its culture, but now also for its growing real estate market.

- Rental yield: 3.5% to 6.3%

- Popular areas: New Town, Salt Lake, EM Bypass, Rajarhat

- Why it’s good: IT parks, colleges, and better roads are increasing rent.

Thane

Thane is next to Mumbai but is more affordable. It’s now a popular choice for renting.

- Rental yield: 4% to 5.2% (some places even 6% to 7%)

- Popular areas: Ghodbunder Road, Thane West, Majiwada

- Why it’s good: Close to Mumbai, new metro, and lower property cost

Kochi

Kochi is a growing port and IT city in Kerala. It’s also popular with tourists and NRIs.

- Rental yield: 3% to 5%

- Popular areas: Kakkanad, Edappally, Marine Drive

- Why it’s good: Growing business, smart city projects, and tourism boost.

| City | Average Rental Yield | Best Areas |

| Bengaluru | 3.5% – 4.5% (up to 7%) | Whitefield, Sarjapur, HSR Layout |

| Mumbai | 2% – 2.5% (up to 5%) | Bandra, Powai, Thane, Navi Mumbai |

| Gurugram | 2.5% – 4% | DLF, Golf Course Road, New Gurugram |

| Noida | 2.6% – 3.2% (up to 6%) | Sectors 62, 150, Noida Expressway |

| Hyderabad | 4% – 5% | HITEC City, Gachibowli, Financial Dist |

| Pune | 3% – 4% (up to 5%) | Hinjewadi, Dhanori, Viman Nagar |

| Chennai | 3.5% – 4% (up to 6%) | OMR, Tambaram, Porur, Ambattur |

| Ahmedabad | 3.9% – 4.1% | SG Highway, Bopal, Satellite |

| Kolkata | 3.5% – 6.3% | New Town, Salt Lake, Rajarhat |

| Thane | 4% – 5.2% (up to 7%) | Thane West, Ghodbunder Road |

| Kochi | 3% – 5% | Kakkanad, Edappally, Marine Drive |

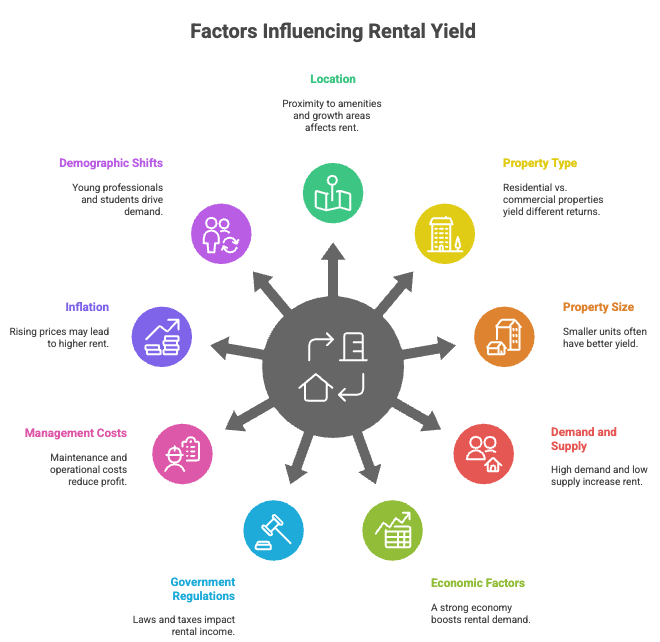

Factors Influencing Rental Yield in India

Many things affect how much rent you can earn from a property. Let’s look at the main factors that change the rental yield in different cities and areas in India.

Location of the Property

Where your property is located is very important. Homes near offices, colleges, metro stations, markets, and hospitals are easier to rent and earn more money.

- Good location = higher rent

- Far-away or underdeveloped areas = lower rent

If the area is growing fast, with new roads, metros, or offices, rent will likely go up in the future.

Property Type (Residential vs. Commercial)

The type of property also matters:

- Homes (residential) give 2% to 5% rental yield.

- Shops or offices (commercial) can give 7% to 10%.

Even among homes, flats in societies with good amenities (gym, security, park) get better rent. Luxury flats give less yield because they cost too much, but the rent doesn’t match.

Property Size and Condition

- Smaller flats like 1BHK or 2BHK usually give better rental yield.

- Bigger homes may give higher rent, but not always higher yield.

Also, well-maintained houses get more rent. If a flat is dirty, broken, or too old, people may not want to rent it, or will pay less.

Demand and Supply Dynamics

If many people want to rent in an area (high demand) and few houses are available (low supply), rents go up.

But if too many homes are available to rent and fewer people want them, rent goes down.

Cities with growing jobs and college students usually have higher demand.

Economic Factors

When the country’s economy is doing well:

- More people have jobs.

- More people move to cities.

- More people can afford rent.

This increases rental demand. But if the economy is weak, fewer people can pay rent or may move back home, which lowers rental income.

Government Regulations

Government laws also affect rental income:

- Rent control laws stop landlords from raising rent too much.

- Property taxes and stamp duties increase costs and reduce profit.

- But if the government builds new roads or metro lines nearby, rents may increase.

Property Management and Operational Costs

If you manage your property well, you will get good tenants and less damage.

But if you don’t maintain the property or handle issues, you may lose rent or spend more on repairs.

Also, things like maintenance charges, insurance, repairs, and vacancy periods reduce your profit.

Inflation and Cost of Living

When prices of everything go up (inflation), landlords may increase rent too.

In cities with a high cost of living, rent is also higher. But if you raise the rent too much, tenants might leave.

So, you need to balance your rent with what people can afford.

Demographic Shifts

Cities with more:

- Young professionals

- Students

- Small families (nuclear families)

Usually have higher demand for 1BHK and 2BHK homes.

Also, if many people are moving into a city for jobs or studies, rental demand goes up. That’s why places near IT parks or colleges often give higher rental yield.

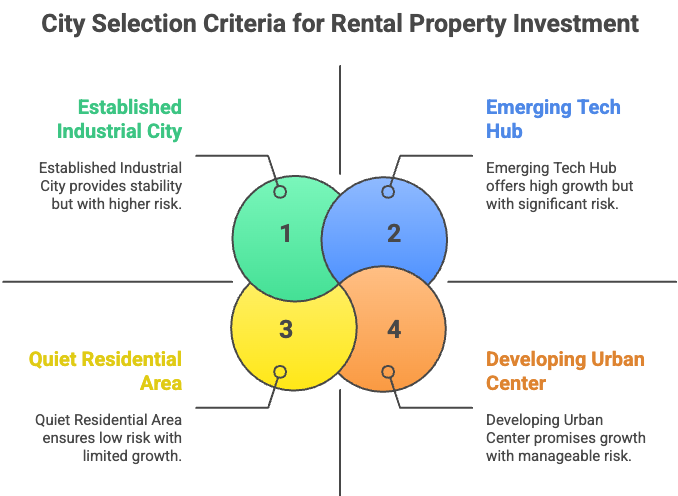

How to Choose the Best City?

Choosing the right city to buy a property for rental income is very important. It’s not just about looking at where rent is high right now; you also need to think about the future.

- Research Market Trends and Forecasts

Study real estate trends and future predictions. Focus on cities with growing property prices, rising rent, and job opportunities. Reports from experts can help you choose cities likely to grow and give better returns.

- Analyze Infrastructure Development

Check for new or upcoming metro lines, highways, airports, and IT parks. Better infrastructure increases demand and rent value. A well-connected area becomes more attractive to tenants.

- Evaluate Job Market and Economic Growth

Cities with strong job markets attract more renters. Look for places with big companies, industries, and low unemployment. A good economy means stable rental income and reliable tenants.

- Consider Population Growth and Demographics

Growing cities with young professionals, students, or families have higher rental demand. Knowing who lives in the city helps you choose the right type of property, like smaller flats near colleges or big homes near schools.

- Assess Affordability and Property Prices

High rent is good, but not if the property price is too expensive. Compare prices and rental income in different areas. Sometimes, smaller or less popular cities give better rental yield with lower investment.

- Understand Local Regulations and Taxation

Local rules, taxes, and rent laws affect your profit. Some cities limit rent increases or have high property taxes. Learn about legal costs before investing to avoid surprises.

- Diversify Your Portfolio

Don’t put all your money in one city. Investing in different cities reduces risk and increases chances of good returns. If one area does badly, others might still perform well.

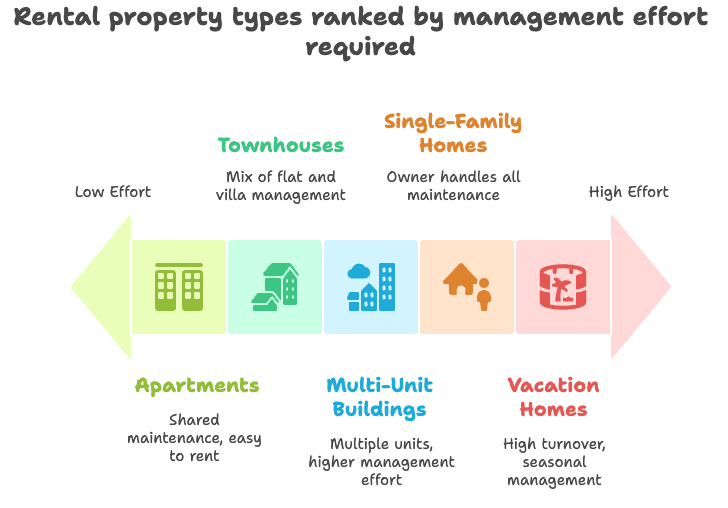

Comparing Different Types of Rental Properties

When investing in rental properties in India, the type of property you choose significantly impacts the potential rental yield. Each property type comes with its own set of advantages and disadvantages, influencing factors like initial investment, maintenance costs, tenant demand, and ultimately, profitability. Understanding these distinctions is crucial for aligning your investment strategy with your financial goals.

- Multi-Unit Buildings:

These are buildings with more than one rental unit (like duplexes or small apartments). They can give multiple rents from one property, so if one flat is empty, others still earn income. They usually need more money to buy and more effort to manage, but they can give higher overall returns. - Apartments:

The most common rental property in Indian cities. They are easy to rent out, especially in gated communities with gyms, security, and parks. Affordable or mid-range flats usually give better rental income than luxury ones. Maintenance is often shared with society, which is helpful. - Single-Family Homes:

These are independent houses or villas. Families like them for the space and privacy, but they may pay lower rent compared to flats. They can become more valuable over time (good for long-term gain), but the owner must handle all maintenance, which increases costs. - Vacation Homes:

Found in tourist places like Goa or hill stations. These can earn more per night than regular rentals, but only during busy seasons. Off-season, they may stay empty. They also need more work, like cleaning and managing guests, and the income can be unpredictable. - Townhouses:

These are homes connected to other similar houses in a row, often with multiple floors and a small yard. They are a mix of flats and villas. Popular with small families and professionals. They give rental yields similar to apartments but offer more space and privacy.

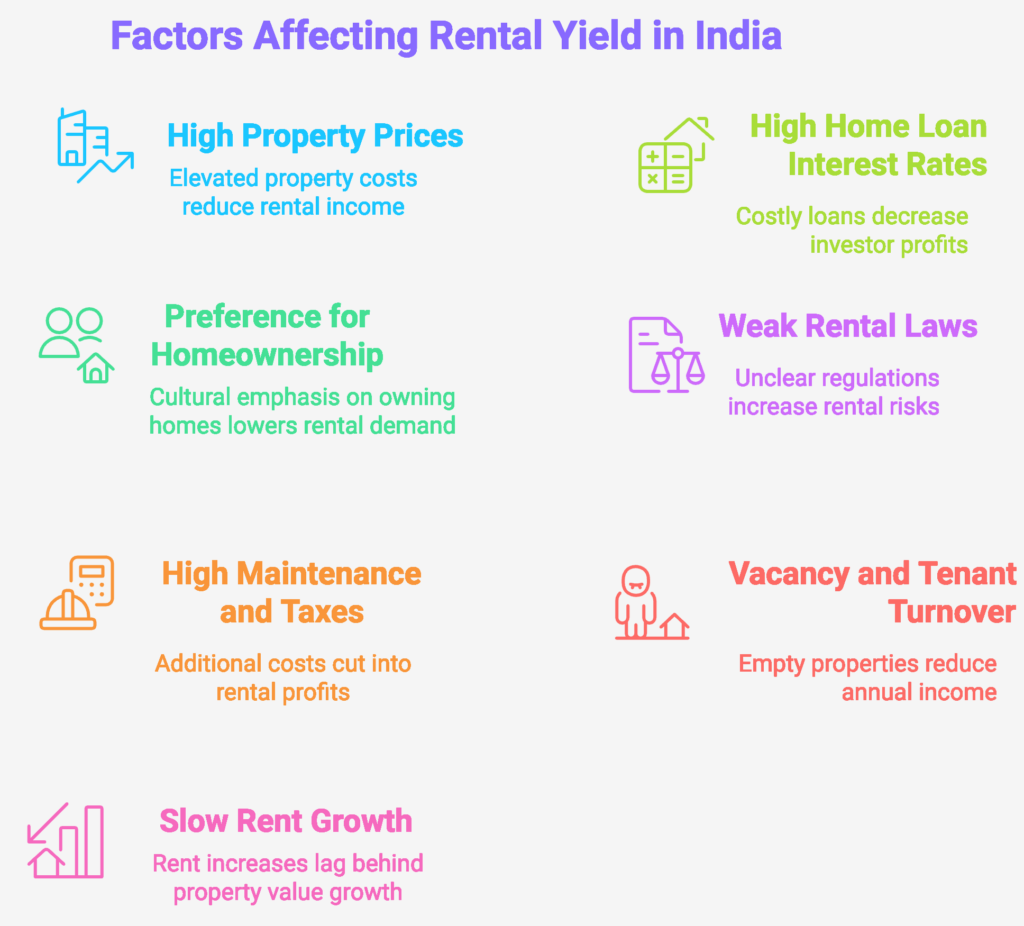

What are the Reasons for Low Rental Yield in India?

Despite the promising outlook in certain cities, India has historically experienced relatively low rental yields compared to many other global real estate markets. Several underlying factors contribute to this phenomenon, making it crucial for investors to understand these dynamics before committing their capital.

- High Property Prices

In many Indian cities, property prices are very high, but rent has not increased at the same speed. So, even if you buy an expensive flat, the rent you get may still be low, which reduces your rental yield. - People Prefer Buying Homes

Many Indians believe owning a home is important for social status and security. Because of this, more people want to buy homes rather than rent, which lowers demand and limits how much rent landlords can charge. - High Home Loan Interest Rates

Interest rates on home loans in India are higher than in some other countries. This makes buying and maintaining property more expensive for investors, which cuts into their profits from rent. - Weak Rental Laws and Rules

Rental rules are different in every state and often unclear. In some places, landlords can’t raise rent easily or may face legal problems with tenants. This makes renting riskier and less profitable. - High Maintenance and Property Taxes

Landowners have to pay property tax, society fees, and maintenance charges. These extra costs reduce the actual profit from rent, especially since landlords can’t always charge higher rent to cover them. - Empty Houses and Tenant Changes

When a flat is empty, the landlord earns nothing. Finding new tenants also costs time and money. In some cities, this happens often, reducing the total rental income over the year. - Slow Rent Growth

While property prices go up, rent doesn’t increase as fast. This means rental income stays low even though the home’s value rises. So, investors rely more on the future value of the property than the rent they earn now.

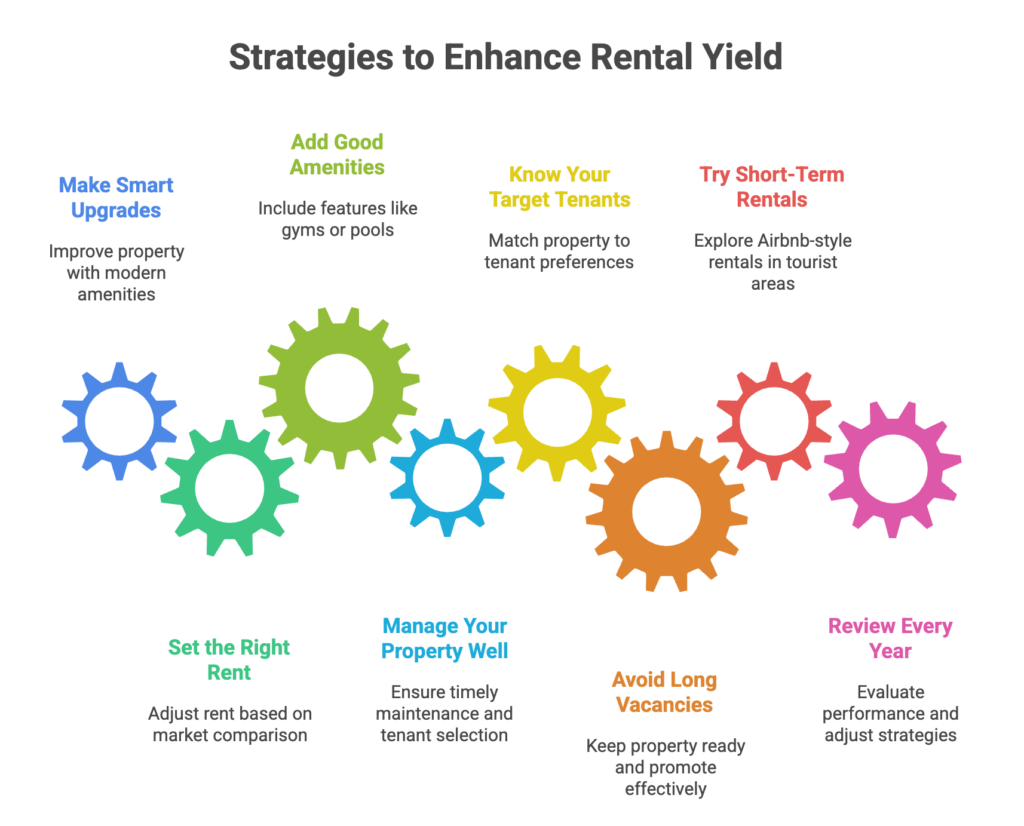

How to Increase the Rental Yield of Your Property?

Even though rental income in India can sometimes be low, there are smart ways to earn more. With the right improvements, good management, and proper planning, you can make your property give you better returns.

- Make Smart Upgrades

Improve your property with clean paint, modern kitchens, nice flooring, or energy-saving gadgets. These changes make the home more attractive and can help increase rent but only spend on things that give good returns. - Set the Right Rent

If rent is too high, tenants may not come. If it’s too low, you earn less. Compare with nearby homes and adjust based on the property’s size, location, and features. Keep checking and updating your rent every year. - Add Good Amenities

Extra features like gyms, pools, gardens, fast internet, or security can attract better tenants and allow you to charge more. Choose amenities that match what your target renters want. - Manage Your Property Well

Fix problems quickly, choose good tenants, and collect rent on time. A well-managed property stays rented longer. If you’re too busy or live far away, hiring a manager can helpit’s worth the cost. - Know Your Target Tenants

Match your property to the people who are most likely to rent it. For example, students like small flats near colleges; families prefer bigger homes near parks and schools. This helps reduce empty periods. - Avoid Long Vacancies

When your home is empty, you lose money. Keep it clean and ready to show. Use websites, agents, and social media to promote it. Answer calls fast and make it easy for people to move in. - Try Short-Term Rentals (Carefully)

In tourist cities, short-term rentals (like Airbnb) can earn more per night. But they also cost more and need more effort. Also, check local rules before trying this option may not always give better results. - Review Every Year

Keep track of rent rates, property value, and tenant feedback. Review your rental yield at least once a year and make changes to improve earnings. Staying updated helps you stay profitable.

Conclusion

To make the most out of your investment, it is important to understand how rental yield works, how to calculate it, and what factors can change it. Things like location, type of property, and how well the property is managed can all affect how much money you can earn.

Although rental yields in India were low in the past, they are now rising because of more job opportunities, better roads, and more people moving to cities. If you invest in the right area and take good care of your property, you can earn steady money every year.

Real estate investment is not just about buying a flat or house. It is about planning carefully, choosing wisely, and managing your property well. With proper knowledge and effort, you can turn your property into a good source of income and also see its value grow in the future.

FAQs

1. What is the difference between gross rental yield and net rental yield?

- Gross rental yield = Rent you earn in a year ÷ Property price × 100

It does not include costs like maintenance or taxes.

It’s easy to calculate, but not 100% accurate. - Net rental yield = (Rent − All yearly costs) ÷ Property price × 100

It gives a clearer picture of how much real money you earn after expenses.

It’s better to know the true profit.

2. How often should I review my property’s rental yield?

You should at least review it once a year. Property value, rent, and expenses can change over time. Checking yearly helps you to see if your property is still a good investment, know if you should increase the rent, and decide if you need to repair or upgrade the property

3. Are there specific areas in India known for higher rental yields?

Yes! Some places give better rental income than others. These are usually near IT parks and offices, Colleges and universities, and areas near Metro stations or busy roads

4. How can property management affect rental yield?

Effective property management significantly impacts rental yield. Good management ensures tIf you manage your property well, you can:

- Get better tenants

- Avoid long gaps between tenants (no rent loss)

- Fix problems early to avoid big repairs

- Collect rent on time

But if you don’t manage it well, you may lose rent, face repairs, or have bad tenants.

Good management = higher rental yield.

5. Should I invest in short-term rentals for better yields?

Short-term rentals (like Airbnb) can give more money per day, but:

- They need more cleaning and work

- You may not get guests all the time

- It can be risky in the off-season

So, they can earn more, but they are also harder to manage than regular long-term rentals.

About the Author

Shivanshi Dheer

Shivanshi Dheer sharing actionable strategies and information on PG/hostel management to help simplify renting and scale with RentOk.