Property Tax

Tips to Reduce Tax on Rental Income: Expert Advice 2025

Written by

Shivanshi Dheer

Read Time

9 min read

Posted on

June 3, 2025

Overview

Overview

Rental income can be a lucrative source of earnings, but high tax obligations can significantly cut into your profits. With smart tax planning and expert-backed strategies, landlords can legally reduce their tax liabilities while maximizing returns. In this guide, we’ll explore practical methods to save on taxes, highlight key deductions, and explain how digital accounting tools, especially those integrated with RentOk, can simplify tax management in 2025.

What is Tax on Rental Income in India?

Rental income from your house property is considered “income from house property” under the Income Tax Act. This means that the rent you receive is taxable after allowing for certain deductions and adjustments. Whether you rent out an entire property or just a portion, understanding how your rental income is computed is key to effective tax planning.

Understanding Income from House Property

Income from house property isn’t simply the rent you receive—it’s calculated based on the property’s Gross Annual Value (GAV). The GAV is derived by considering the expected rent if the property were fully rented out, less any deductions like municipal taxes. This figure forms the basis for further deductions and eventually your taxable income.

How Rental Income is Taxed in India

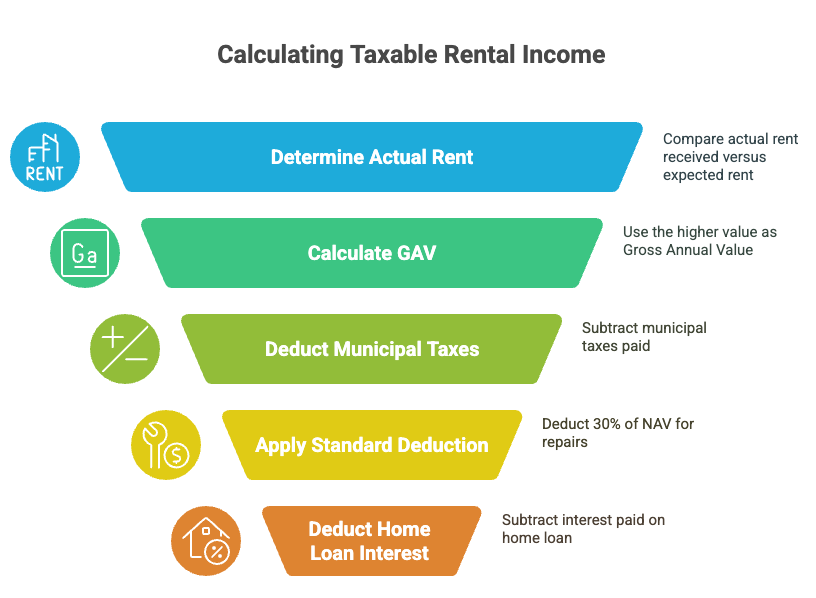

The process for taxing rental income generally involves:

- Calculating Expected Rent: Estimating the rent your property could fetch if fully let.

- Determining Gross Annual Value (GAV): The higher of the expected rent or the actual rent received.

- Deducting Municipal Taxes: To arrive at the Net Annual Value (NAV).

- Applying Standard Deductions: Typically 30% of the NAV for repairs and maintenance.

- Subtracting Home Loan Interest: If applicable, this further reduces taxable income.

- Computing the Final Taxable Income: The resulting amount is then subject to income tax slabs.

For example, if your GAV is ₹8,00,000, and you pay ₹1,00,000 in municipal taxes, your NAV becomes ₹7,00,000. After a standard deduction of 30% (₹2,10,000) and subtracting any home loan interest, the remaining figure is taxed according to the prevailing tax slabs.

Types of Rental Income Taxation

Rental income taxation can vary depending on the property and usage:

- House Property with Partial Self-Occupation: When you live in a part of the property and rent out the remainder.

- Rental Income from Land, Buildings, and Apartments: Different properties may have varying deductions.

- Composite Rent from Building and Asset Letting: When you rent out both the property and associated assets.

- Retail Revenue from Stores on an Owner’s Property: Income from commercial spaces is treated differently.

Understanding these categories can help you optimize your tax savings.

How to Calculate Tax on Rental Income

Steps to Calculate Tax on Rental Income

- Calculate Expected Rent: Determine the potential rent for a fully let property.

- Calculate Actual Rent and GAV: Compare actual rent received versus the expected rent; use the higher value as GAV.

- Deduct Municipal Taxes: Subtract the municipal taxes paid to find the Net Annual Value (NAV).

- Apply Standard Deduction (30% of NAV): This covers repairs and maintenance.

- Deduct Home Loan Interest: If you have a home loan, subtract the interest paid.

- Calculate Taxable Income: The remaining income is what’s subject to tax.

Example Calculation

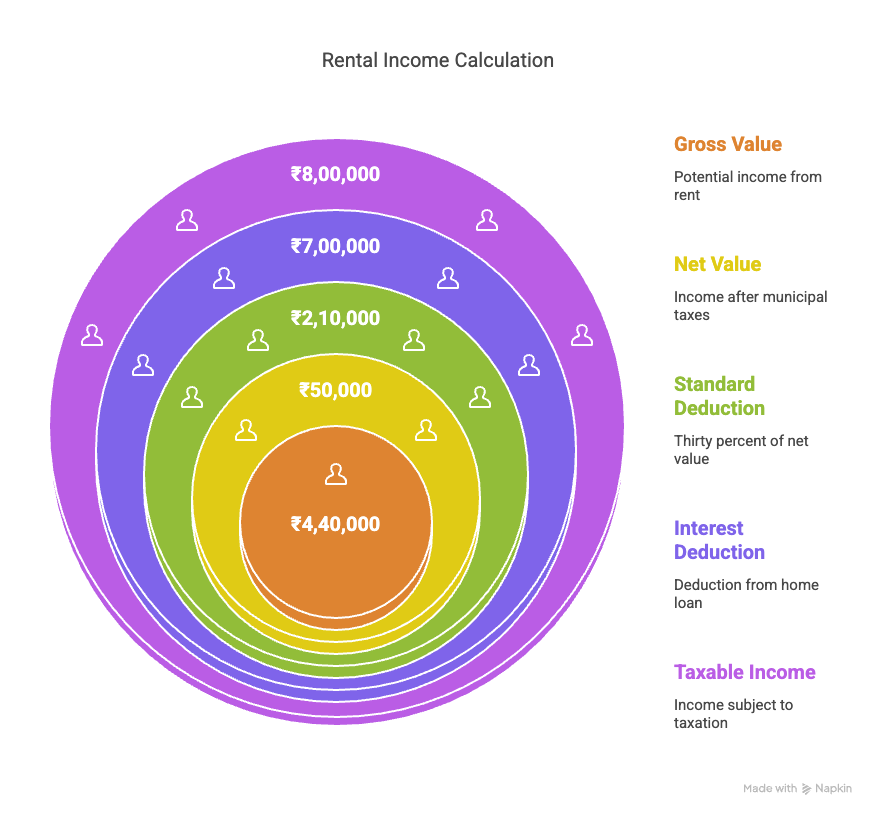

- Gross Annual Value (GAV): ₹8,00,000

- Property Tax Paid: ₹1,00,000

- Net Annual Value (NAV): ₹7,00,000

- Standard Deduction (30%): ₹2,10,000

- Interest on Home Loan: ₹50,000

- Taxable Income: ₹7,00,000 – ₹2,10,000 – ₹50,000 = ₹4,40,000

This figure is then taxed based on the applicable income tax slab.

Tax Benefits and Deductions

Standard Deductions for Repairs and Renovations (Section 24A)

A standard deduction of 30% on NAV helps cover repair expenses and maintenance costs.

Deduction for Home Loan Interest (Section 24B)

Interest on home loans is deductible, which can significantly reduce your taxable income.

Additional Benefits for First-Time Homeowners

Under Sections 80EE and 80EEA, first-time homebuyers may avail of additional tax benefits.

Deductions for Co-Owners

If a property is jointly owned, co-owners can claim certain expenses to lower their tax liabilities.

Properties Not Taxable in India

Certain properties are not subject to rental income tax, including:

- Properties Used for Business: When the property is primarily used for business purposes.

- Revenue from Agricultural Lands: Income from agriculture is generally exempt.

- Real Estate Held by Local Authorities: Government and local authority properties.

- Charitable or Religious Institutions: Including those in medicine and education.

- Owner-Occupied Homes: If no rental income is generated.

Common Issues and Special Scenarios

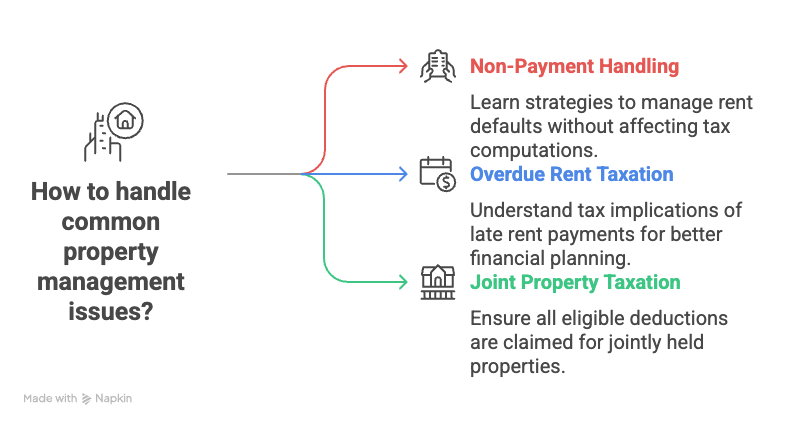

Handling Non-Payment or Defaulted Rent

Learn how to manage situations where tenants default on rent without jeopardizing your tax computations.

Taxation of Overdue Rent

Understanding how late rent payments are treated can help in planning your finances better.

Taxation of Properties Held in Common

Special rules apply for jointly held properties—ensure you’re claiming all eligible deductions.

What is Taxable Rental Income?

Taxable rental income is determined by the Income Tax Act, considering:

- The Gross Annual Value of the property.

- Deductions such as municipal taxes, standard deductions, and home loan interest.

Understanding these provisions helps in calculating your overall tax liability accurately.

Understanding Rental Income Taxation

Before diving into tax-saving strategies, it’s crucial to understand how rental income is taxed. In India, rental income is classified as “income from house property” and must be reported in your annual tax return. However, by utilizing various deductions and exemptions, you can reduce your overall tax burden.

How Rental Income is Calculated

Rental income is generally determined by the following formula:

Total Rent Received – Allowable Deductions = Taxable Rental Income

Tax rates vary based on factors such as location, property type, and ownership structure. Understanding this framework is the first step to effective tax planning.

Ways to Reduce Your Tax Burden on Rental Income

- Claim House Rent Allowance: If applicable, to lower taxable income.

- Utilize the New Tax Regime: Analyze its implications for rental income.

- Maximize Deductions: Always claim eligible deductions such as municipal taxes, repairs, and interest on home loans.

- Avoid Common Mistakes: Ensure you don’t misreport income or ignore eligible deductions.

Top Tax-Saving Strategies for Landlords in 2025

1. Claim All Eligible Deductions

One of the most effective ways to lower your taxable rental income is by claiming every eligible deduction. Common deductible expenses include:

- Mortgage Interest: The interest portion of your mortgage payments is tax-deductible.

- Property Taxes: Local government taxes on rental properties can be claimed.

- Maintenance and Repairs: Expenses required to maintain the property in habitable condition.

- Depreciation: Claiming depreciation allows you to account for the wear and tear on your property over time.

- Property Management Fees: Fees paid for managing your property are deductible.

- Legal and Professional Fees: Costs incurred for hiring accountants or legal advisors.

- Utilities and Insurance: Expenses that you bear, such as utilities and insurance premiums, are also deductible.

2. Optimize Rental Property Depreciation

Depreciation is a powerful tax-saving tool. Landlords can deduct the depreciation of their property over its useful life. In 2025, be sure to utilize the latest depreciation schedules set by tax authorities to maximize your deductions.

3. Structure Ownership for Tax Efficiency

Depending on your overall income, consider restructuring your property ownership under an LLC, trust, or another tax-efficient entity. This strategy can reduce overall tax liabilities. Consult a tax expert to determine the best structure for your rental business.

4. Use Tax Credits for Energy-Efficient Upgrades

Governments are increasingly offering tax credits for energy-efficient property upgrades. Installing solar panels, energy-efficient appliances, or smart thermostats may qualify you for additional tax credits or rebates, reducing your tax burden while increasing your property’s value.

5. Leverage 1031 Exchange for Capital Gains Deferral

For landlords planning to sell a property and reinvest in another, a 1031 exchange (and its equivalents in other countries) allows you to defer capital gains taxes. This strategy is particularly beneficial for expanding your rental portfolio without incurring immediate tax penalties.

6. Split Rental Income to Lower Tax Brackets

If you own property jointly with a spouse or family member, distributing rental income between multiple owners can help keep each individual in a lower tax bracket, thereby reducing overall tax liability.

7. Keep Immaculate Records for Expense Tracking

Accurate record-keeping is essential for tax optimization. Digital tools like RentOk enable you to track expenses, categorize deductions, and generate automated tax reports, ensuring that you claim every eligible deduction while minimizing audit risks.

Common Mistakes to Avoid When Filing Rental Taxes

Even with smart strategies, common pitfalls can lead to increased tax liabilities:

- Failing to Report All Income: Underreporting rental earnings can result in hefty fines.

- Claiming Personal Expenses: Ensure that you do not mix personal expenses with rental property costs.

- Incorrect Depreciation Calculations: Using outdated methods can lead to missed deductions.

- Missing Filing Deadlines: Late submissions can attract penalties and interest.

- Not Seeking Professional Advice: Tax laws evolve; consulting an expert ensures you remain compliant and maximize deductions.

How RentOk Simplifies Tax Management for Landlords

Managing rental property taxes manually can be overwhelming. RentOk offers a smooth digital solution that streamlines your tax preparation, expense tracking, and compliance. Here’s how:

Key Features of RentOk for Tax Management

- Automated Expense Tracking: RentOk categorizes all property-related expenses, ensuring that every deductible cost is recorded accurately.

- Tax-Ready Reports: Generate comprehensive, tax-friendly reports that simplify filing and reduce your reliance on manual accounting.

- Rental Income Analytics: Get real-time insights into your rental earnings and understand their tax implications.

- Integration with Accounting Software: Seamlessly sync data with popular accounting platforms to streamline tax preparation.

- Audit-Proof Documentation: Securely store all financial records on the cloud, reducing audit risks and ensuring you can always retrieve necessary documentation.

By leveraging RentOk, you can ensure accurate tax filings, maximize your deductions, and save valuable time while staying fully compliant with tax regulations.

Conclusion

Reducing tax on rental income in 2025 is achievable with a combination of strategic planning, smart deductions, and the use of digital tools. By claiming all eligible deductions, optimizing property depreciation, structuring ownership efficiently, and utilizing RentOk for seamless tax management, landlords can significantly cut their tax burdens while remaining compliant with regulations.

If you want to simplify rental tax management? Start using RentOk today!

About the Author

Shivanshi Dheer

Shivanshi Dheer sharing actionable strategies and information on PG/hostel management to help simplify renting and scale with RentOk.

Stay ahead in property management with expert insights

Join thousands of property managers receiving exclusive tips delivered straight to your inbox.

Browse posts by category

Case Study

Cost of Living

Gandhi Jayanti

Growth

Legal

Market Trends

News

Pg owner app

Property Management

Property Tax

RentOk

The easiest way to rent and manage your PGs and hostels.

Get the app

Contact us

hello@eazyapp.tech

HQ Office

COGROW, BASEMENT F-12/8A

BESIDE HOUSE OF STYLE SALON, SECTOR 28, DLF PHASE 1

GURUGRAM, HARYANA - 122002

South India Office

LUMIODESK COWORKING, 2ND FLOOR, 40, 14TH MAIN RD

BESIDE MC DONALD, 7TH SECTOR, HSR LAYOUT

BENGALURU, KARNATAKA - 560102