Market Trends

5 Hidden Rental Costs You Should Know Before Signing

Written by

Shivanshi Dheer

Read Time

7 min read

Posted on

June 17, 2025

Overview

Overview

5 Hidden Rental Costs You Should Know Before Signing

Moving into a new rental property is often an exciting chapter, filled with dreams of fresh starts and new experiences. You’ve likely budgeted for the monthly rent, perhaps even the security deposit and first month’s rent. But what if I told you that the sticker price on that rental listing might not be the full story? Let’s find out what are the 5 Hidden Rental Costs You Should Know Before Signing

Understanding these potential financial surprises before you sign on the dotted line is absolutely crucial. It empowers you to make a truly informed decision, negotiate if possible, and avoid any unwelcome financial shocks down the road. In this comprehensive guide, we’ll pull back the curtain on five common hidden rental costs that often go unnoticed, helping you navigate the rental market with confidence and ensure your new home doesn’t come with an unexpected price tag.

Beyond the Rent Costs: Why You Need to Look Deeper

The advertised rent is just one piece of the financial puzzle when it comes to renting. Many other expenses, some recurring and some one-time, can significantly impact your overall cost of rental costs. Landlords and property managers aren’t always upfront about every single fee, and it’s up to you, the prospective tenant, to be diligent and ask the right questions. Overlooking these can lead to budget shortfalls and unnecessary stress.

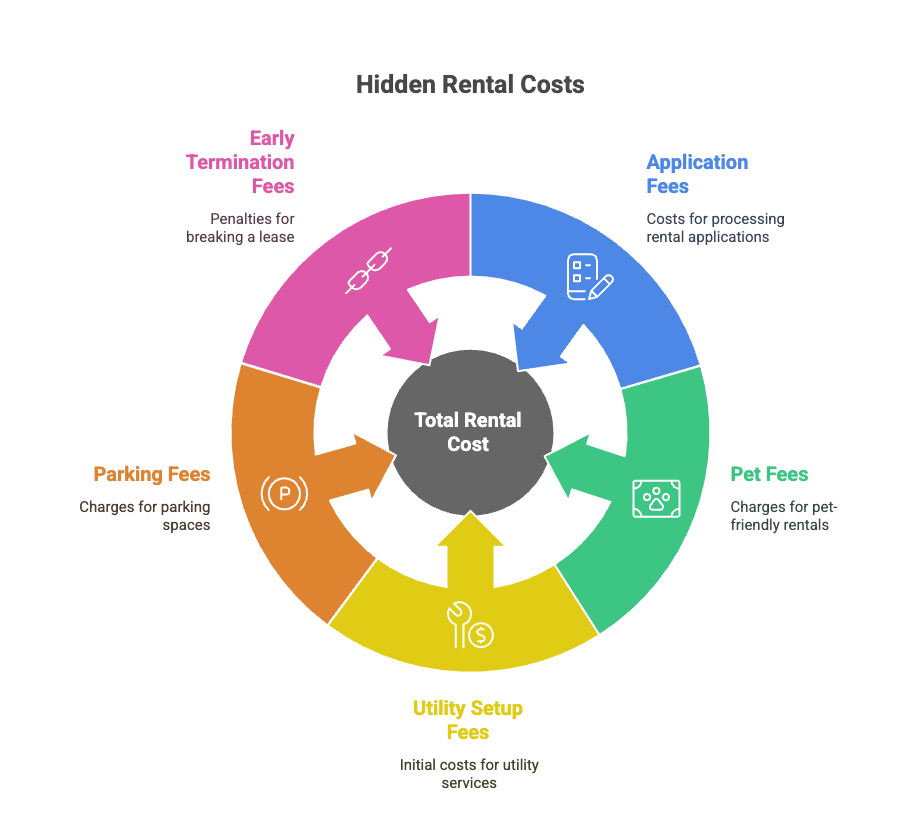

The Top 5 Hidden Rental Costs to Watch Out For

Let’s delve into the specific hidden rental costs that often surprise tenants:

Application Fees and Background Check Fees

Before you even get a chance to sign a lease, many landlords or property management companies will charge an application fee. This fee covers the cost of processing your application, which typically includes running a credit check, criminal background check, and verifying your employment and rental history. Although these checks are standard practice, the fees can vary significantly and are usually non-refundable, even if your application is denied. If you apply to multiple properties, these common rental costs can quickly add up.

Some platforms like RentOk streamline the entire application and screening process digitally, so landlords are more transparent about costs from the start.

What to look for: Ask about application fees upfront. Are they per applicant or per application? Are they refundable under any circumstances?

Why it’s hidden: Often seen as a necessary administrative cost, but can be a significant upfront expense not included in the advertised rent.

Pet Fees, Pet Deposits, and Pet Rent

For animal lovers, finding a pet-friendly rental is a priority. However, being pet-friendly often comes with its own set of hidden rental costs. Many landlords charge a one-time pet fee (non-refundable), a refundable pet deposit (similar to a security deposit, but specifically for pet-related damages), and even recurring “pet rent” added to your monthly rent.

What to look for: If you have a pet, explicitly ask about all pet-related charges: fees, deposits, and monthly rent. Get it in writing.

Why it’s hidden: While some landlords are transparent, others might only mention it in the fine print, assuming you’ll ask.

Utility Setup Fees and Unexpected Utility Bills

You might expect to pay for utilities like electricity and water, but the initial setup fees for these services often catch tenants off guard. Some apartment complexes also handle or split utility bills in ways you might not anticipate. For example, landlords may charge a flat fee or usage-based rate for water, sewer, or trash services instead of billing through the utility company. Most landlords on Rentok use Smart electricity meters to avoid this confusion. Don’t forget about internet and cable setup fees either; those can add up quickly.

What to look for: Identify which utilities are included in the rent and which ones you are responsible for paying separately. Ask about average monthly costs for previous tenants and any one-time setup fees.

Why it’s hidden: People assume tenants understand that utilities are extra, but they often don’t discuss the nuances of billing and initial costs.

Parking Fees and Amenity Fees

That convenient parking spot or access to the building’s gym and pool might not be free. Many apartment complexes and even individual landlords charge separate fees for designated parking spaces, especially in urban areas. Similarly, access to “luxury” amenities like fitness centers, swimming pools, or clubhouses can come with an additional monthly or annual fee, regardless of whether you use them.

What to look for: Inquire about parking costs (if any) and whether amenity access is included in the rent or requires an extra charge. Don’t assume anything is free.

Why it’s hidden: These are often presented as optional extras or assumed benefits, but can quickly become mandatory rental costs.

Early Termination Fees and Lease Renewal Fees

Life happens, and sometimes you might need to break a lease early. Be aware that most lease agreements include hefty early termination fees, which can amount to several months’ rent. On the flip side, if you plan to stay long-term, some landlords charge a lease renewal fee to cover administrative costs associated with drafting a new agreement. These are crucial rental costs to understand.

What to look for: Carefully read the clauses regarding early termination and lease renewal. Understand the penalties for breaking the lease and any fees for extending it.

Why it’s hidden: Legal jargon in the lease often buries these terms, and they only become apparent when you need to use them.

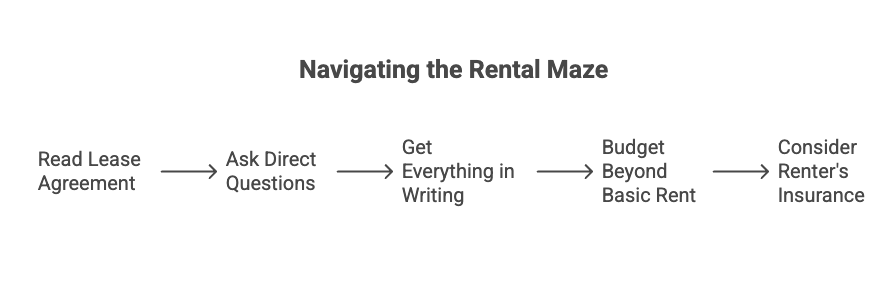

What should be your action plan?

Being aware of these hidden rental costs is the first step. Here’s how you can proactively protect yourself:

- Thoroughly Read the Lease Agreement: It can not be stressed enough, but please don’t skip it! Read every single clause, especially those related to fees, deposits, and responsibilities.

- Ask Direct Questions: Don’t be afraid to ask your landlord or property manager about any fees not explicitly mentioned in the advertised rent. Get clarification on anything unclear.

- Get Everything in Writing: Verbal agreements are hard to enforce. Document all agreed-upon terms, including any waived fees or special arrangements, in your lease.

- Budget Beyond Basic Rent: When calculating what you can afford, factor in potential application fees, utility estimates, pet charges, and any other fees you uncover.

- Consider Renter’s Insurance: While sometimes a mandatory rental cost, even if not, it’s a wise investment to protect your belongings and provide liability coverage.

Conclusion

The journey to a new rental home should be exciting, not financially stressful. By being proactive and understanding these five common hidden rental costs, application fees, pet charges, utility nuances, parking/amenity fees, and lease termination clauses, you can approach the rental agreement with confidence. Remember, the key is thorough research, asking direct questions, and getting every detail in writing. Don’t let unexpected expenses overshadow the joy of your new living space. Sign smart, and enjoy a stress-free rental experience with tools like RentOk helping you stay informed and in control.

FAQs

Q1: What is an application fee, and is it refundable?

An application fee is a charge by landlords or property managers to cover the cost of processing your rental application, including background and credit checks. These fees are typically non-refundable, even if your application is denied. Always confirm this before paying.

Q2: Are pet deposits the same as pet fees or pet rent?

No, they are distinct rental costs. A pet deposit is usually a one-time, refundable payment held to cover potential pet-related damages. A pet fee is a one-time, non-refundable charge for allowing a pet. Pet rent is a recurring monthly charge added to your regular rent for having a pet on the premises.

Q3: How can I find out about utility costs before signing a lease?

Ask the landlord or property manager for an estimate of average monthly utility costs for the unit. You can also contact the local utility providers (electricity, water, gas) and ask for past usage data for the specific address. This helps uncover potential hidden rental costs related to utilities.

Q4: What happens if I need to break my lease early?

Most lease agreements include an early termination clause. This typically outlines significant penalties. This can range from forfeiting your security deposit to paying several months’ rent as a penalty. Always review this clause carefully before signing to understand the financial implications of early lease termination.

About the Author

Shivanshi Dheer

Shivanshi Dheer sharing actionable strategies and information on PG/hostel management to help simplify renting and scale with RentOk.